CCTV2 Outline of Remarks on Dollar Perspective

CCTV2 評(píng)論美元前景的提綱

By F. William Engdahl 2 August 2009

I would like to address the future prospect for the US Dollar as the world key or reserve currency. The answer requires a brief look at what determines the relative value of the dollar today. Since President Nixon freed the dollar from gold exchange in August 1971 the dollar has been a floating currency whose value, high or low, has often been determined by political considerations as well as financial market perceptions for the future.

我在這里要對(duì)美元作為世界主要貨幣或者儲(chǔ)備貨幣的前景的做一個(gè)判斷。首先需要簡(jiǎn)略地討論一下,今天的美元價(jià)值是如何確定的?自從尼克松總統(tǒng)1971年8月宣布放棄金本位以來(lái),美元一直是一個(gè)浮動(dòng)的貨幣,美元的價(jià)值高低往往是由政治上的考慮和金融市場(chǎng)前景預(yù)期決定的。

The relative value of the dollar since 1971 has been a very political value. That is my point.

自從1971年以來(lái),美元的相對(duì)價(jià)值始終是一個(gè)由政治決定的價(jià)值。這是我的主要判斷。

In the context of the global financial crisis which first erupted in summer 2007 around the US sub-prime real estate problems, the dollar has defied many economists by remaining surprisingly strong despite the fact that the US financial system is in its worst crisis in all its 220 year history and its economy is sinking into what is already the worst recession since the 1930’s Great Depression. To say what the future of the dollar might be it is necessary to examine why the dollar remains relatively stable since 2007.

從2007年夏天以來(lái)、由次貸開(kāi)始的全球金融危機(jī),美元出乎意料的強(qiáng)勢(shì)打破了許多經(jīng)濟(jì)學(xué)家的預(yù)計(jì),盡管美國(guó)的金融系統(tǒng)是處于220年歷史上最糟糕的狀態(tài)中,美國(guó)經(jīng)濟(jì)也陷入了1930年大蕭條以來(lái)最嚴(yán)重的衰退。為了討論美元的前途,我們必須查看一下,美元為何能從2007年以來(lái),在危機(jī)中還保持了相對(duì)穩(wěn)定。

- Net capital flows into dollar:

凈資本輸入美元體系

If the US economy goes into severe recession/depression as it has since 2007, then the relative value of the dollar against major trading currencies especially Japan Yen and Euro or Canadian dollar should also fall.

如果美國(guó)經(jīng)濟(jì)確實(shí)從2007年就進(jìn)入了衰退或者蕭條,那么美元相對(duì)于主要貿(mào)易伙伴的貨幣價(jià)值就應(yīng)該下降,例如日元,歐亞和加拿大元等。

What has the dollar done against the Euro, its major trading currency? The course has been extremely volatile since 2007, up and down. In January 2007 before the first signs of crisis in the US Mortgage-Backed Securities market, the dollar-euro stood at 1.30 and remained in a trading range to 1.36 until July 2007. By November 2007, as the crisis became evident across the banking system the dollar fell to 1.48 to the euro.

那么美元相對(duì)于歐元這個(gè)主要的貿(mào)易貨幣采取了何種行動(dòng)?自從2007年以來(lái)的過(guò)程是非常動(dòng)蕩的,大起大伏。在美國(guó)抵押貸款證券市場(chǎng)危機(jī)的跡象出現(xiàn)之前,2007年1月美元和歐亞的兌換率是1.30,交易中的匯率幅度可達(dá)1.36,這個(gè)匯率一直維持到2007年7月。到當(dāng)年的11月,當(dāng)危機(jī)在整個(gè)銀行體系中跡象很明顯的時(shí)候,美元――歐元 兌換率變成了1.48。

In 2008 dollar-euro was wildly volatile as bank failures in USA and UK spread and by April 2008 dollar fell to 1.60 to euro. Central banks around the world coordinated action after the September 15 decision by the US Government to let Lehman Bros. fail, because a systemic crisis developed globally as risk became incalculable. No one knew anymore which US banks were “too big to fail.”

2008年全年,美元-歐元的關(guān)系大幅度變動(dòng),美英銀行失敗,到四月美元下降到1.60美元兌換一歐元。全球的央行在9月15日雷曼兄弟公司破產(chǎn)后采取了聯(lián)合行動(dòng),因?yàn)轱L(fēng)險(xiǎn)變得無(wú)法預(yù)計(jì),整個(gè)世界的金融體系陷入了危機(jī)。誰(shuí)也不知道還有哪一個(gè)美國(guó)的銀行是因?yàn)椤疤蟆倍荒艿归]的。

Yes, the dollar recovered to 1.28 by October 2008. The reason was simple. Central banks had moved to contain the dollar crisis that time and then private capital flows rushed back into the dollar. Why? Because US mutual funds, US banks, US corporations all were forced to repatriate their foreign profits to cover losses in the US. As well, European corporations that had borrowed in dollars were forced to find dollars at any price, as loans came due. All those flows drive the dollar artificially high then despite the severe crisis.

毫無(wú)疑問(wèn),在2008年的8月,美元匯率恢復(fù)到1.28。原因很簡(jiǎn)單。各國(guó)央行采取了遏制危機(jī)的行動(dòng),私人的資本回流到美元體系中。為什么會(huì)這樣?因?yàn)槊绹?guó)的對(duì)沖基金、美國(guó)的銀行、美國(guó)的公司都被迫把利潤(rùn)調(diào)回來(lái)填補(bǔ)在美國(guó)發(fā)生的虧損。同樣,歐洲的公司必須不惜代價(jià)找到美元,歸還到期的美國(guó)貸款。所有這些貨幣流動(dòng),在嚴(yán)重的危機(jī)中推高了美元的價(jià)值。

What about the most recent dollar stability? Here we see the effect of the propaganda campaign of Wall Street banks and Washington since March 9, to drive a “suckers’rally” in the S&P 500 stocks and to speak of seeing “green shoots” of recovery. The Obama Administration under direction of Economic Czar Larry Summers, has already manipulated US economic data for GDP and other data more than any president in history to date, to help fuel the myth of recovery. The latest US GDP data announced July 31 contained the largest revision to GDP statistics in history, whose effect is to make the GDP decline look like recession is ending. The “recession” is not ending. It is just beginning. The worst is yet to come.

那么最近美元的穩(wěn)定又該如何解釋?我們?cè)谶@里看到華爾街銀行和華盛頓3月9日以來(lái)宣傳戰(zhàn)的成功,它們開(kāi)動(dòng)了一場(chǎng)“標(biāo)準(zhǔn)/普爾500股票 ”吸血鬼狂歡,還說(shuō)什么看見(jiàn)了復(fù)蘇的“綠意”。奧巴馬政府在經(jīng)濟(jì)沙皇萊爾.薩莫斯的領(lǐng)導(dǎo)下修改了美國(guó)GDP等數(shù)據(jù),做得比任何往屆政府都更惡劣,用這個(gè)辦法來(lái)制造復(fù)蘇的神話。7月31日公布的最近的美國(guó)GDP數(shù)字被修正得好像“衰退”已經(jīng)觸底。其實(shí)衰退還剛剛開(kāi)始,最糟糕的事情還沒(méi)有發(fā)生。

- The US economic reality: 美國(guó)經(jīng)濟(jì)現(xiàn)實(shí)

The reality of the US economy is opposite the propaganda of Wall Street.

美國(guó)經(jīng)濟(jì)的現(xiàn)實(shí)和華爾街的宣傳正相反。

In real economic terms, the US Economy is already in a Depression. The Grand Benchmark Revision of the National Income Accounts on July 31, 2009 confirmed that the US economy is in its worst economic contraction since the first down wave of the Great Depression in the early 1930s.

從真正的經(jīng)濟(jì)意義上講,美國(guó)的經(jīng)濟(jì)已經(jīng)陷入蕭條。2009年7月31日的經(jīng)過(guò)基準(zhǔn)數(shù)字修訂的國(guó)民收入,可以確認(rèn)美國(guó)經(jīng)濟(jì)已經(jīng)出現(xiàn)了大蕭條以來(lái)最嚴(yán)重的緊縮。

As one former Reagan Treasury official recently stated, “There is no economy left to recover. The US manufacturing economy was lost to off-shoring and free trade ideology. It was replaced by a mythical ‘New Economy’ based on services. It was fed by the Federal Reserve's artificially low interest rates, which produced a real estate bubble, and by "free market" financial deregulation, which unleashed financial gangsters to new heights of debt leverage and fraudulent financial products.”

里根的一位前財(cái)政部官員最近這樣說(shuō)過(guò),“我們已經(jīng)沒(méi)有什么可以恢復(fù)的經(jīng)濟(jì)了。美國(guó)的制造業(yè)經(jīng)濟(jì)已經(jīng)輸給了‘外包’和自由貿(mào)易的意識(shí)形態(tài),被一個(gè)建筑在服務(wù)業(yè)基礎(chǔ)上的奇妙的‘新經(jīng)濟(jì)’取代了。這個(gè)新經(jīng)濟(jì)被美聯(lián)儲(chǔ)人為壓低的利率支撐起來(lái),被房地產(chǎn)泡沫、被‘自由的市場(chǎng)’金融‘去監(jiān)管化’釋放出來(lái)的犯罪團(tuán)伙、被更高的債務(wù)杠桿和帶有欺詐內(nèi)容的金融產(chǎn)品滋養(yǎng)出來(lái)了。”

When that make-believe economy collapsed, Americans' wealth in their real estate, pensions, and savings collapsed dramatically while their jobs disappeared. The debt economy caused Americans to leverage their assets. They refinanced their homes and spent the equity. They spent their limit on numerous credit cards. They worked as many jobs as they could find. Debt expansion and multiple family incomes kept the US economy going over the past two decades.

當(dāng)這個(gè)自欺欺人的經(jīng)濟(jì)垮下去的時(shí)候,當(dāng)美國(guó)人工作崗位消失的時(shí)候,他們?cè)诜康禺a(chǎn)、養(yǎng)老基金和儲(chǔ)蓄中的財(cái)產(chǎn)也大規(guī)模地垮掉了。這個(gè)債務(wù)經(jīng)濟(jì)迫使美國(guó)人把自己的財(cái)產(chǎn)當(dāng)作杠桿來(lái)使用:他們?yōu)樽约旱淖≌偃谫Y,把自己的資產(chǎn)押進(jìn)去。他們把無(wú)數(shù)信用卡上的信貸額度用完了。他們盡量多兼職工作。是債務(wù)的擴(kuò)張和每個(gè)家庭都盡量多地兼職,才把美國(guó)經(jīng)濟(jì)又支撐了20年。

Now suddenly Americans can't borrow in order to spend. They are over their heads in debt. Jobs are disappearing. America's consumer economy, approximately 70% of GDP, is dead. Those Americans who still have jobs are saving against the prospect of job loss. Millions are homeless. Some have moved in with family and friends; others are living in tent cities.

然后突然之間美國(guó)人不能借債消費(fèi)了。他們背負(fù)的債務(wù)已經(jīng)淹沒(méi)了他們自己。工作崗位不斷消失。這個(gè)要消費(fèi)國(guó)民生產(chǎn)總值70%以上的美國(guó)的消費(fèi)經(jīng)濟(jì)已經(jīng)死亡。還在就業(yè)的美國(guó)人也在為了將來(lái)可能失業(yè)而儲(chǔ)蓄了。成百萬(wàn)的人又變得無(wú)家可歸。有一些和親朋好友擠住,另外的搬進(jìn)了帳篷“市區(qū)”。

The current economic downturn increasingly will be referred to as a depression. It is far from over. This downturn will continue to deteriorate, be extremely protracted, extremely deep and not responsive to traditional economic stimulus. July 2009 marked the 19th month of US economic contraction, the longest downturn since the early 1930s first down wave of the Great Depression. The most recent quarterly GDP contractions, as well as annual declines of 3.3% and 3.9%, respectively, in first- and second-quarters 2009, are the worst in the history of the quarterly GDP series that goes back to 1947.

越來(lái)越多的人會(huì)把目前發(fā)生的經(jīng)濟(jì)下滑稱為衰退。“見(jiàn)底”還遠(yuǎn)得很。這個(gè)下降趨勢(shì)會(huì)惡化和持續(xù)非常長(zhǎng)久的時(shí)間,會(huì)衰退得非常深,而且無(wú)力回應(yīng)通常的經(jīng)濟(jì)刺激手段。2009年的7月是美國(guó)經(jīng)濟(jì)收縮的第19個(gè)月,已經(jīng)是大蕭條以來(lái)最長(zhǎng)久的收縮。在2009年第一季度和第二季度發(fā)生的經(jīng)濟(jì)收縮的規(guī)模(3.3% ),年度經(jīng)濟(jì)收縮的規(guī)模(3.9%,),已經(jīng)是1947年以來(lái)最糟糕的情境了。

The US economy suffers from severe underlying structural problems tied to consumer debt relative to income. Households cannot keep up with inflation and no longer can rely on excessive debt expansion for meeting short-falls in maintaining living standards. The structural issues are not being addressed meaningfully by the Obama stimulus programs. They cannot be addressed without a significant fundamental change in government economic and trade policies, which under the best of circumstances still would drag out economic depression for many years to come. In short, since 2007 US consumers have been saving to pay down their huge credit card, auto and home debts. They are not and will not consume for a long time. In the past 12 months they have reduced debt by a staggering $2 trillion. That has reduced the economic growth seriously and is the driver of the depression. There is no choice.

美國(guó)經(jīng)濟(jì)正在面臨的是的深刻的結(jié)構(gòu)問(wèn)題,它是消費(fèi)者過(guò)度負(fù)債和收入之間的長(zhǎng)期關(guān)系的后果。居民家庭的收入無(wú)法跟上通漲的速度,同時(shí)又不能再依靠過(guò)度借貸維持短期的生活水平不要下降。奧巴馬政府的刺激計(jì)劃根本沒(méi)有觸及這個(gè)結(jié)構(gòu)性問(wèn)題。如果不徹底改變政府的經(jīng)濟(jì)政策、政治政策和貿(mào)易政策,這個(gè)問(wèn)題也是無(wú)法觸及的,既使是在最好的情境下,這個(gè)結(jié)構(gòu)性問(wèn)題也會(huì)在將來(lái)很多年月里導(dǎo)致經(jīng)濟(jì)的衰退。概括地說(shuō),2007年以來(lái)美國(guó)消費(fèi)者已經(jīng)在儲(chǔ)蓄,為了支付信用卡消費(fèi)、為購(gòu)買汽車和住房而儲(chǔ)蓄。他們?cè)诤荛L(zhǎng)的時(shí)間里不能再“消費(fèi)”。僅僅在過(guò)去的12個(gè)月里,他們就消減了2萬(wàn)億美元的債務(wù),這個(gè)行動(dòng)同時(shí)也壓低了經(jīng)濟(jì)發(fā)展的速度,是使經(jīng)濟(jì)發(fā)生蕭條的“發(fā)動(dòng)機(jī)”。但是他們已經(jīng)沒(méi)有別的選擇了。

If we calculate data in absence of the official manipulation or “cooking the books”, the real estimate of unemployment is above 20% today, not the official 9.5%. The GDP is declining at the most severe rate since the Second World War and rapidly nearing levels of the Great Depression.

如果我們不受政府的影響來(lái)分析數(shù)據(jù),不“玩弄統(tǒng)計(jì)”數(shù)字,那么今天美國(guó)的失業(yè)率已經(jīng)達(dá)到20%,不是官方宣布的9.5%。GDP下降的速度也是二戰(zhàn)以來(lái)最快的,迅速逼近了大蕭條的水平。

US manufacturing output is collapsing. Household debt levels are at the highest in US history over 300% of disposable income. Corporate debt is equally high. Government debt is at a record and soon to reach 100% of GDP. The United States economy is caught in a debt trap of its own making.

美國(guó)制造業(yè)產(chǎn)出正在垮下來(lái)。家庭負(fù)債的水平是美國(guó)歷史上最高的――達(dá)到可支配收入的300%。公司負(fù)債的水平也達(dá)到這個(gè)水平。政府債務(wù)水平也創(chuàng)了紀(jì)錄,不久將同GDP相等。美國(guó)經(jīng)濟(jì)已經(jīng)落入了它自己制造出來(lái)的債務(wù)陷阱。

3. Prospects for the dollar: 美元的前途

China is today in the new position of being the world’s largest creditor. Suddenly leading G7 officials and prominent people like former IMF head Candessus say “We should invite China to a seat at the Big Table” Why? They forget today that “Table” is “Made in China” US is world’s largest net debtor. They hope China will use its wealth to bailout the dollar system that is collapsing. I assume Chinese policymakers are more intelligent than they do and that they will continue to look to securing national economic security in this crisis. It will be complicated but not impossible.

今天的中國(guó)坐上了世界最大債主的第一把交椅。突然之間,G7的官員和國(guó)際大腕們,例如前IMF的總裁坎迪薩斯(Candessus) 說(shuō),“我們應(yīng)當(dāng)邀請(qǐng)中國(guó)坐到‘大桌’前邊來(lái)。”為什么要他們邀請(qǐng)中國(guó)?他們是否忘記了“大桌子”是“中國(guó)制造”?美國(guó)才是世界上最大的負(fù)債者。他們想讓中國(guó)用自己的財(cái)富把崩潰中美國(guó)體系拯救出來(lái)。我假定,中國(guó)的決策者其實(shí)思考的比行動(dòng)更深,他們將繼續(xù)努力在這場(chǎng)危機(jī)中保衛(wèi)國(guó)民經(jīng)濟(jì)的安全。解決問(wèn)題很復(fù)雜,但決不是不可能。

Since 1985 when the United States became a net debtor country for the first time since the First World War, the United States has become the world’s largest net debtor country. As of January 2009, America's net international investment position was a negative $3.47 trillion, the Commerce Department reported. That represents the difference between the value of U.S. assets owned by foreigners ($23.36 trillion) and the value of foreign assets owned by Americans ($19.89 trillion). The USA as a single entity, public and private owes the world $3.47 trillion. Much of that is to China, ironically. The USA is a military superpower today but an economic dwarf.

美國(guó)自從1985年以來(lái)一直是一個(gè)凈負(fù)債的國(guó)家,這是從一戰(zhàn)以來(lái)首次出現(xiàn)的情境。現(xiàn)在美國(guó)已經(jīng)是世界上最大的負(fù)債國(guó)。2009年1月,美國(guó)商務(wù)部報(bào)告美國(guó)的凈國(guó)際投資是負(fù)的3.47萬(wàn)億美元。這是這個(gè)數(shù)字是外國(guó)人擁有的美國(guó)資產(chǎn)(23.36萬(wàn)億美元)和美國(guó)人擁有的外國(guó)資產(chǎn)(19.98萬(wàn)億美元)之差。作為一個(gè)整體的美國(guó),公私兩方共欠全世界3.47萬(wàn)億美元。其中很大一部分是欠中國(guó)的。今天的美國(guó)是軍事上的巨人,在經(jīng)濟(jì)上已經(jīng)成了侏儒。

During 2008 alone the USA net debt grew by $1.33 trillion, or 62 percent. The tendency is not getting better as bank bailout and other economic coats soar.

僅僅在2008年一年中,美國(guó)的凈債務(wù)就增加了1.33萬(wàn)億美元,增幅是62%。迄今這個(gè)趨勢(shì)沒(méi)有發(fā)生任何改變,因?yàn)橐仁校€有其他的經(jīng)濟(jì)成本都在飛升。

Foreigners now hold nearly 50 percent of the federal government's publicly held debt. If foreign investors significantly reduce their purchase of future US Treasury debt securities, without even dumping their current holdings, US interest rates could soar and the dollar could collapse. America's net debtor status with foreigners is at the highest level in US history.

外國(guó)人現(xiàn)在事實(shí)上持有聯(lián)邦政府差不多50%的公共債務(wù)。如果外國(guó)投資人真的開(kāi)始減少購(gòu)買今后的美國(guó)財(cái)政部的債券,甚至不用減持已購(gòu)買的債務(wù),美元利率就會(huì)飛升,美元就會(huì)大跌。美國(guó)欠外國(guó)人的債務(wù)的規(guī)模達(dá)到美國(guó)歷史上前所未有的水平。

That did not matter as long as the dollar remained world reserve currency and as long as foreign investors financed that debt with buying US Government bonds and other assets, good or bad.

當(dāng)美元還是世界儲(chǔ)備貨幣的時(shí)候,欠債是不成問(wèn)題的,只要外國(guó)投資人還來(lái)購(gòu)買美國(guó)政府債券和其他資產(chǎn),不論好壞,欠債都不成為問(wèn)題。

In recent years two major sources of dollar buying have supported the US dollar. One has been the rising dollar price of world oil. That lasted through approximately August 2008 when oil began to fall dramatically from its all-time high of $147 a barrel to levels around $40 by January 2009. Lower oil price means lower demand for trade dollars.

最近幾年里,有兩種因素支持了美國(guó)的美元。第一是石油價(jià)格高漲。2008年8月前后漲到最高點(diǎn)147美元一桶,隨后大跌至2009年1月的40美元左右。低落的石油價(jià)格意味著對(duì)美元的需求疲軟。

The other major source of dollar support has come from trade surplus countries with the USA whose central banks have little place to invest those dollars as safe as in US Government debt. The largest dollar debt buyers in the recent past for different reasons have been the central banks of Russia, Japan and, far ahead of all others—The Peoples Bank of China.

支持美元價(jià)值的第二個(gè)因素是世界各國(guó)對(duì)美國(guó)的貿(mào)易順差,那些國(guó)家的央行沒(méi)有什么別的地方去投資,把美國(guó)政府債務(wù)當(dāng)成了安全避風(fēng)港。最近出于不同的理由,購(gòu)買美元債務(wù)最大的買主中有俄國(guó)、日本等國(guó)家;而遠(yuǎn)遠(yuǎn)超了過(guò)所有的買主,中國(guó)的人民銀行是最大的買家。

The United States economic model of the past thirty years of ongoing trade and current account deficits is nearing the end of sustainability, as financial markets and foreign governments begin to worry it is not sustainable any longer. No one can say when the dollar will react, but that it must fall in the months ahead is clear. Only a dramatic and unexpected war might conceivably buy a little more time for the dollar. Even that is not certain so great are the deficits.

以往30年的美國(guó)的對(duì)外貿(mào)易和經(jīng)常賬戶赤字經(jīng)濟(jì)模型是不可持續(xù)的,現(xiàn)在已經(jīng)走到了頭,因?yàn)榻鹑谑袌?chǎng)和外國(guó)的政府開(kāi)始擔(dān)憂,這個(gè)模式再也不能維持了。無(wú)人能夠準(zhǔn)確地說(shuō)出美元何時(shí)會(huì)出“變數(shù)”,但是在今后不久美元將要貶值是確定無(wú)疑的。只有戲劇性變化或者出乎意料的戰(zhàn)爭(zhēng),也許才能為美元再贏得一點(diǎn)生存的時(shí)間,而且由于這樣做所要付的代價(jià),做了是否就有用也是很難說(shuō)的。

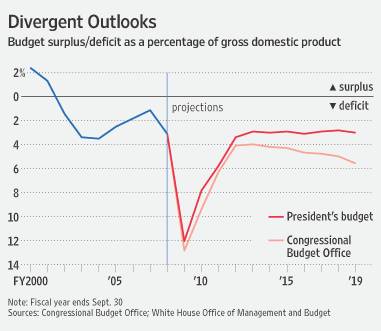

The United States today is caught in a deadly debt trap much as Argentina or other Third World countries were during the 1980’s. But that is not all. The prospects for Federal US Government deficits going forward are extremely negative as well:

美國(guó)今天實(shí)際上已經(jīng)陷入了和阿根廷以及第三世界在1980年一樣的債務(wù)陷阱。這還沒(méi)有完,美國(guó)聯(lián)邦政府對(duì)付赤字的前景同樣是極端的陰暗。

Conclusion 結(jié)語(yǔ)

The US government's budget deficit has jumped from $455 billion in 2008 to $2,000 billion this year, with another $2,000 billion on the books for 2010. And President Obama has intensified America's expensive war in Afghanistan and initiated a new war in Pakistan.

美國(guó)政府的預(yù)算赤字:2008年4550億美元,將在今年底飆升到2萬(wàn)億美元。奧巴馬總統(tǒng)已經(jīng)在阿富汗擴(kuò)大了戰(zhàn)事,又在巴基斯坦開(kāi)打新的戰(zhàn)爭(zhēng)。

美國(guó)沒(méi)有別的辦法為戰(zhàn)爭(zhēng)融資,除了印刷更多的鈔票,或者壓低股市,那樣做將會(huì)把人們引向放棄財(cái)產(chǎn)轉(zhuǎn)持債券。

There is no way for these deficits to be financed except by printing money or by further collapse in stock markets that would drive people out of equity into bonds.

The US government's budget is 50% in deficit. That means half of every dollar the federal government spends must be borrowed or printed. Because of the worldwide debacle caused by Wall Street's financial greed, the world needs its own money and is growing unwilling to lend $2 trillion annually to lend to Washington. And the US Budget deficit will remain at least $1 trillion or more for the next ten years or more.

美國(guó)政府的預(yù)算赤字達(dá)到50%。這意味著美國(guó)政府每一美元的支出中,有一半必須靠借債或者靠印鈔票。由于全世界都被華爾街的貪婪擊中,這個(gè)世界現(xiàn)在需要自己的貨幣,越來(lái)越不情愿每年拿出2萬(wàn)億美元的錢(qián)借給華盛頓用。美國(guó)的預(yù)算赤字在今后的10年或者更長(zhǎng)的時(shí)期中,至少會(huì)保持在1萬(wàn)億美元或者更高的水平上。

As dollars are printed, the growing supply adds to the pressure on the dollar's role as reserve currency. Already America's largest creditor, China, is warning Washington to protect China's investment in US debt and discussing a new reserve currency to replace the dollar before it collapses. According to various reports, China is spending down its holdings of US dollars by acquiring gold and stocks of raw materials and energy. That makes much sense.

美元鈔票印得越多,對(duì)它作為儲(chǔ)備貨幣功能的壓力就越大。作為美國(guó)最大的債權(quán)國(guó),中國(guó)已經(jīng)警告過(guò)華盛頓,必須保護(hù)中國(guó)投資的安全,并且提出了在美元體系崩潰之前,創(chuàng)造替代美元的新的儲(chǔ)備貨幣這個(gè)問(wèn)題。從多種渠道傳來(lái)的信息表明,中國(guó)正在用美元購(gòu)買黃金和資源/能源的股票。這才是更清醒的做法。

The price of one ounce gold coins is $1,000 despite efforts of the US government to hold down the gold price. How high will this price jump when the rest of the world decides that the bankruptcy of "the world's only superpower" is here?

盡管美國(guó)政府想壓低黃金價(jià)格,每盎司黃金仍然出于1000美元的水平。我們不知道,當(dāng)全世界都認(rèn)為“唯一超級(jí)大國(guó)”崩潰近在眼前的時(shí)候,黃金的價(jià)格會(huì)跳上什么臺(tái)階?

Nothing in Obama's economic policy is directed at saving the US dollar as reserve currency or the livelihoods of the American people. Obama's policy, like Bush's before him, is keyed to the enrichment of Goldman Sachs and the armament industries.

奧巴馬政府的經(jīng)濟(jì)政策中根本沒(méi)有拯救美元儲(chǔ)備貨幣地位、拯救美國(guó)人民生活水平的內(nèi)容。奧巴馬的政策,和他之前的布什政府的政策一樣,都是為高盛和軍事工業(yè)巨頭的財(cái)富服務(wù)的。

Look at the Goldman Sachs representatives in the Clinton, Bush and Obama administrations. This Wall Street firm controls the economic policy of the United States. Little wonder that Goldman Sachs has record earnings. But the US economy is going into severe depression and the dollar with it.

看看高盛派到克林頓政府、布什和奧巴馬政府中的代表,我們就可以看得很清楚,這家華爾街企業(yè)控制了美國(guó)的經(jīng)濟(jì)政策。高盛盈利賺大錢(qián)是沒(méi)有什么稀奇的事情。可是美國(guó)的經(jīng)濟(jì)將要陷入嚴(yán)重的衰退,和經(jīng)濟(jì)衰退走在一起的,將是美元的衰落。

相關(guān)文章

- 社科報(bào):金融危機(jī)下的資本主義制度危機(jī)

- 國(guó)際金融危機(jī)的深層思考——金融危機(jī)預(yù)警機(jī)制初探

- 清湖漁夫:全球性貨幣戰(zhàn)爭(zhēng)的時(shí)代特征

- 從CDS的角度看08危機(jī)真相

- 不是金融危機(jī) 是資本主義的系統(tǒng)性危機(jī)

- 美國(guó)次貸重創(chuàng)重臨 或達(dá)730億美元窟窿

- 金融危機(jī)遠(yuǎn)未成為歷史

- 經(jīng)濟(jì)危機(jī)的邏輯(下篇)——從生產(chǎn)過(guò)剩到金融過(guò)剩的危機(jī)

- 經(jīng)濟(jì)危機(jī)的邏輯——從生產(chǎn)過(guò)剩到金融過(guò)剩的危機(jī)

- 呂永巖:“富外窮內(nèi)”國(guó)際板未面世便現(xiàn)魔影

- 張庭賓:美國(guó)最危險(xiǎn)之地——利率衍生品

- 巨額美債何去何從

「 支持烏有之鄉(xiāng)!」

您的打賞將用于網(wǎng)站日常運(yùn)行與維護(hù)。

幫助我們辦好網(wǎng)站,宣傳紅色文化!

歡迎掃描下方二維碼,訂閱烏有之鄉(xiāng)網(wǎng)刊微信公眾號(hào)